In the state of Florida, the age to obtain a learner’s permit is 15, and the legal age to obtain a driver’s license is 16. With thoughts of freedom racing through teenagers’ minds, a common question arises: Is buying or leasing a car better? This major milestone is a crucial financial decision and can leave buyers with many factors to take into consideration.

Leasing

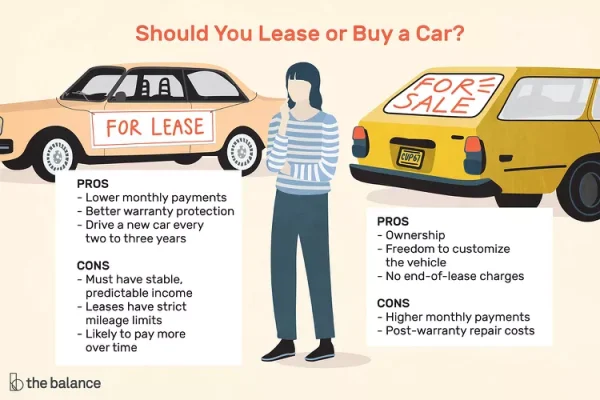

To lease a car means to enter a contract with a dealership, where one would have use of a new vehicle for an allotted time period, typically 24 to 36 months. Since one is only “borrowing” the car, the lease is based on a portion of the car’s value. When the lease is up, the driver has to return the vehicle to the company with the option to either buy it or trade it in for a new lease. With a lease comes some advantages, such as ensuring a teen is provided with a new car with the latest safety features and technology available, offering more protection that an older vehicle might not provide. Another advantage is the proposed affordable monthly payments and full warranty. Even though there are mileage restrictions, which can be a concern for drivers who have to take longer commutes, students who often drive locally aren’t typically bothered with this concern. Ezra Dyer, a Car and Driver senior editor and columnist from Popular Mechanics, offers this advice: “When it comes to leasing vs. buying, leases can actually be a financially savvy move under the right circumstances.” David Doll, General Manager from Mercedes-Benz of Ft. Pierce, advises new drivers looking to acquire a vehicle that “even with extra mileage fees at the end of a lease, damage costs, and disposition fees, a lease is hands-free.”

On the other hand, leasing a car means it’s not considered one’s property, meaning when the vehicle is returned, it’s crucial that it’s returned in good condition. If excessive damage is found on the vehicle, often one incurs additional costs. This can be a major issue for new drivers as they are prone to more damage due to their lack of experience with driving. According to NSC Injury Facts, “Sixteen- to 19-year-olds represent 3.7% of licensed drivers, but account for 8.7% of drivers in all crashes and 6.5% of drivers in fatal crashes.”

Buying

Alternatively, there’s the option to buy a vehicle. This means either one pays the full price of the vehicle upfront or takes out a loan and makes monthly payments until it’s fully paid off. These loans can last from three to six years. Buying comes with some advantages, such as not having mileage restrictions. Buying a vehicle also opens the opportunity to more flexibility and freedom, allowing buyers to modify and personalize the vehicle as they please. The best part is that once the final payment is made, the car is officially one’s possession. One can potentially drive that car payment free for years, saving thousands of dollars. One downside is any vehicle loses its value as soon as it is driven off the lot. Also, the interest rates are high right now, which means that a buyer will pay more than the car’s value at the time of sale over time. According to Bank of America, the APR for a new car is 5.44%, but if one has a bad credit score, the rate can increase.

Ultimately, the choice really depends on one’s savings, how much one drive, and how much one is willing to spend on other expenses like gas, insurance, and maintenance that come with purchasing a car. At the end of the day, each individual needs to weigh the pros and cons for their situation and financial needs to make the best decision for themselves. While buying a car is the best option for some, it may not be for everyone. Lease a vehicle for the “ease, convenience, and financial benefits for people with limited finances,” Doll recommends.

Shannon Scaglione • Oct 20, 2025 at 10:59 am

Very informative. Another great article that helps with real life issues that affect many.